Blog

Avoid These 7 Mistakes First-Time Home Buyers Often Make in Ontario (Toronto & GTA Guide)

Buying a Home with a Basement Apartment: A Smart Move for First-Time Buyers in Ontario

Can I Buy a Home with Student Loans or Car Payments in Ontario? | Toronto Mortgage Guide

Hidden Costs of Buying a Home in Toronto & GTA: Ontario Mortgage Guide

Mortgage Pre-Approval Process Explained in Ontario: A Step-by-Step Guide

Buying a home is one of the biggest financial decisions you’ll ever make. Before you start house hunting in Ontario’s competitive real estate market, one crucial step can save you time, stress, and disappointment — mortgage pre-approval.

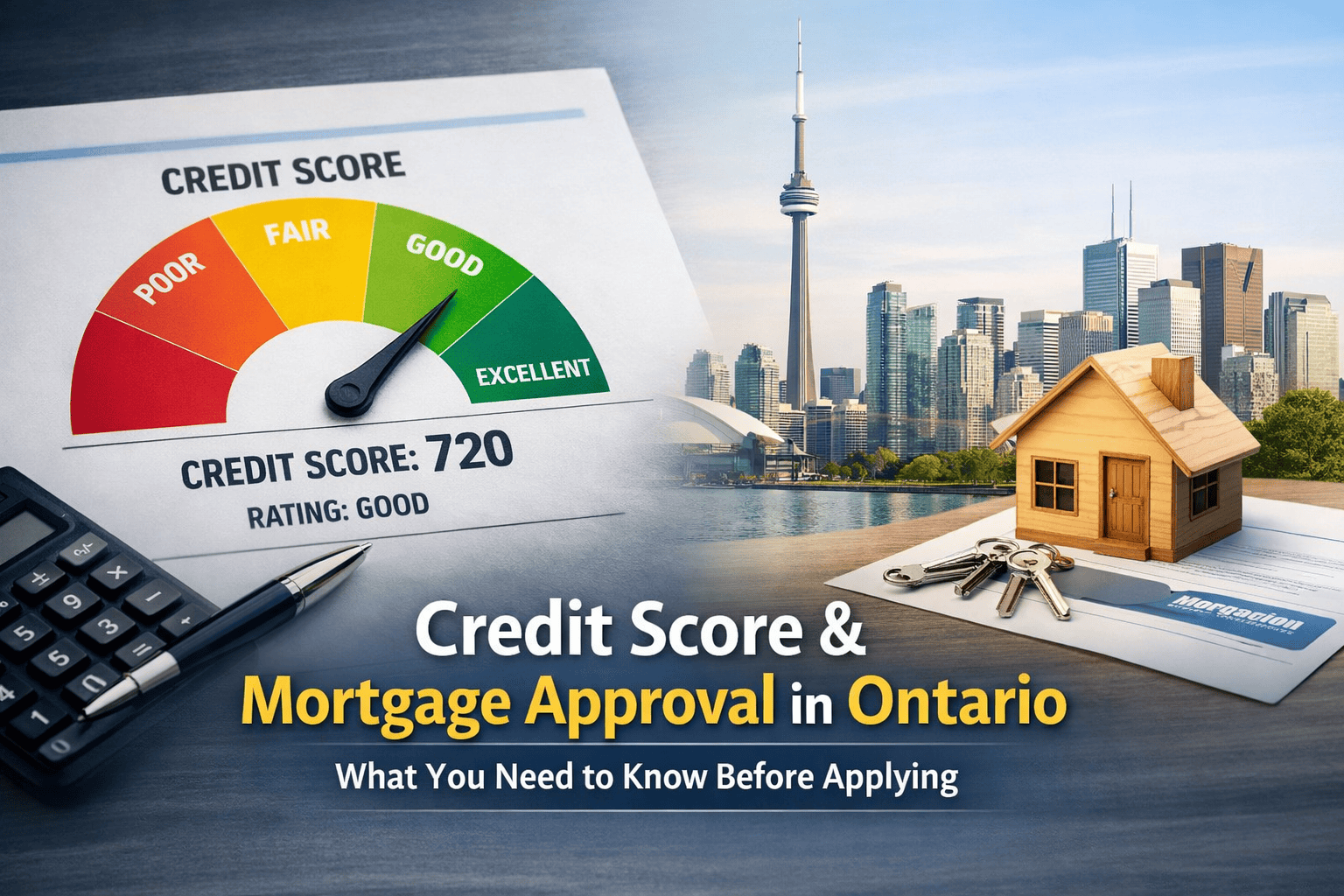

Yet, many home buyers misunderstand what mortgage pre-approval ...Credit Score & Mortgage Approval in Ontario: What You Need to Know Before Applying

Learn how your credit score affects mortgage approval in Ontario. Minimum scores, lender requirements, tips to improve credit, and expert advice from an Ontario mortgage agent.

Introduction: Why Your Credit Score Matters More Than You Think

If you’re planning to buy a home or refinance in ...

Canada Inflation Update – November 2025: What It Means for Ontario Mortgage Rates & Home Buyers

Fixed vs Variable Rate Mortgage: Which One Is Right for You in 2026?

Bank of Canada Holds Rate at 2.25%: What the 4.45% Prime Rate Means for Ontario Homeowners

The Bank of Canada announced today that it is holding the policy interest rate at 2.25%, keeping the Prime rate steady at 4.45%. For homeowners, buyers, and anyone planning a mortgage move this year, this stability brings both clarity and opportunity.

Below is a clear breakdown of what this decision ...

First-Time Home Buyer Incentives Ontario 2025: How to Save $50K–$100K on Your First Home

Ontario Mortgage Down Payment Rules: 5% vs 20% — What’s Best for You?

Understand Ontario’s mortgage down payment rules — when you need only 5%, when 20% makes sense, how CMHC insurance works, and how to save smart.

Navigating the world of mortgages can feel overwhelming — especially when you're trying to decide how much of a down payment to make. In Ontario, the ...

How Much Mortgage Can I Afford in Ontario?

Unlocking Commercial Mortgages: Your Ultimate Guide for Dentists in 2025

Rising Speculation About Interest Rate Cuts in Late 2025 Creates Uncertainty in Fixed vs. Variable Mortgage Choices

Healthy Growth: How Commercial Mortgages & Business Loans Fuel Ontario’s Health Industry

Categories

- Home

(39)

- Blog

(35)

- Uncategorized

(12)

- Finance

(98)

- First Time Home Buyers

(7)

- Commercial Mortgage

(2)